Blog

Added value? Are life insurance perks worth having?

Many life insurance providers now offer additional ‘perks’ to policyholders but are they worth it?

Smartwatches, cinema tickets, gift vouchers and private GP access are just some of the perks now being offered by life insurance providers.

Just like banks offering incentives for you to switch your current account, life insurance firms try to set themselves apart with tempting offers to give them the edge over their competitors.

It's not the best idea to choose a life insurance policy based solely on the perks it offers but it's still worth knowing what's out there when weighing up which provider suits you best.

Here, we examine the perks on offer from some of the main life insurance providers, check how they compare and explain the other factors to consider if you're thinking about taking out a life insurance or critical illness insurance policy.

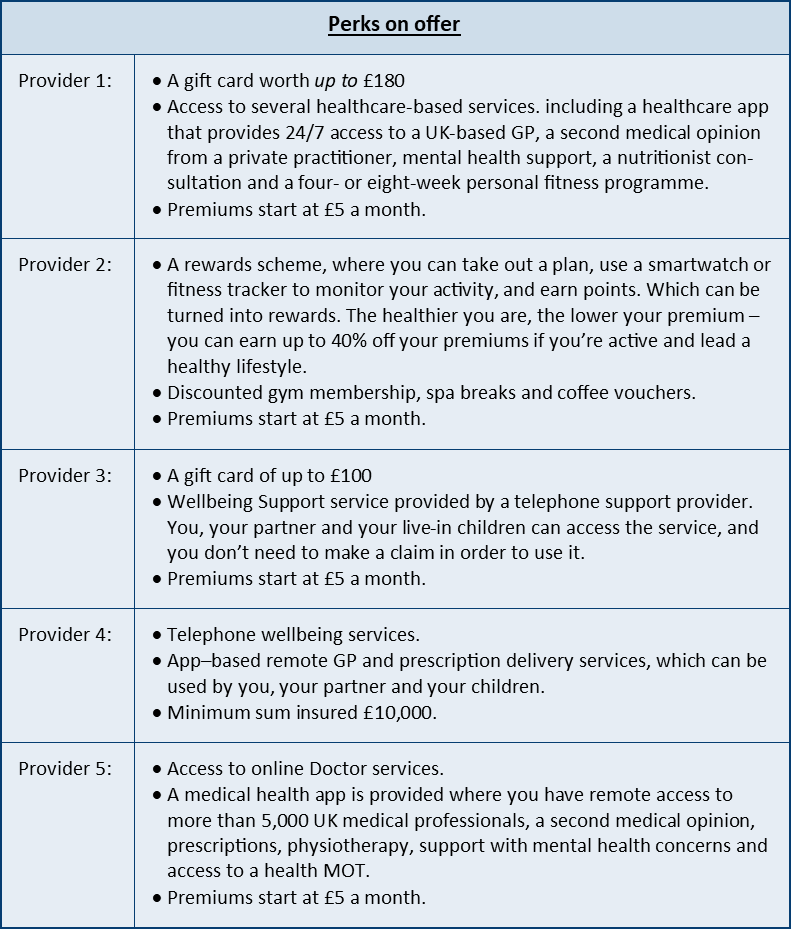

What perks are on offer?

While your life insurance policy is in place to help support your family once you've gone, perks such as gift cards, health insurance, access to a GP 24/7, cinema tickets or coffee mean you can benefit from it, too.

As shown in the table below, we took a look at some of the biggest UK life insurance providers to see what incentives are on offer.

Are the perks worth it?

While these perks may seem attractive, you'll need to balance how much value you'll get from them against the cost of your premium based on your age, health and occupation.

It’s important to shop around to find the best policy for you, regardless of the perks that come with it. As independent financial advisers, we can do that for you.

Do you need life insurance?

Everyone’s circumstances are unique – and some people will not need life insurance. But if you have parents, partners or children that rely on your income, taking out a policy will ensure they’re supported after you die.

An easy way to think about it is: if your income were to disappear, how would the people around you look after themselves? If you have young children and a mortgage to pay, a term life insurance policy might be useful. If you have older children, or have paid off your mortgage, whole-of-life insurance could be a better fit.

There are many different types of life insurance available, and it’s important to make sure you find the right policy for you and your family. Why not ask us for our independent advice?