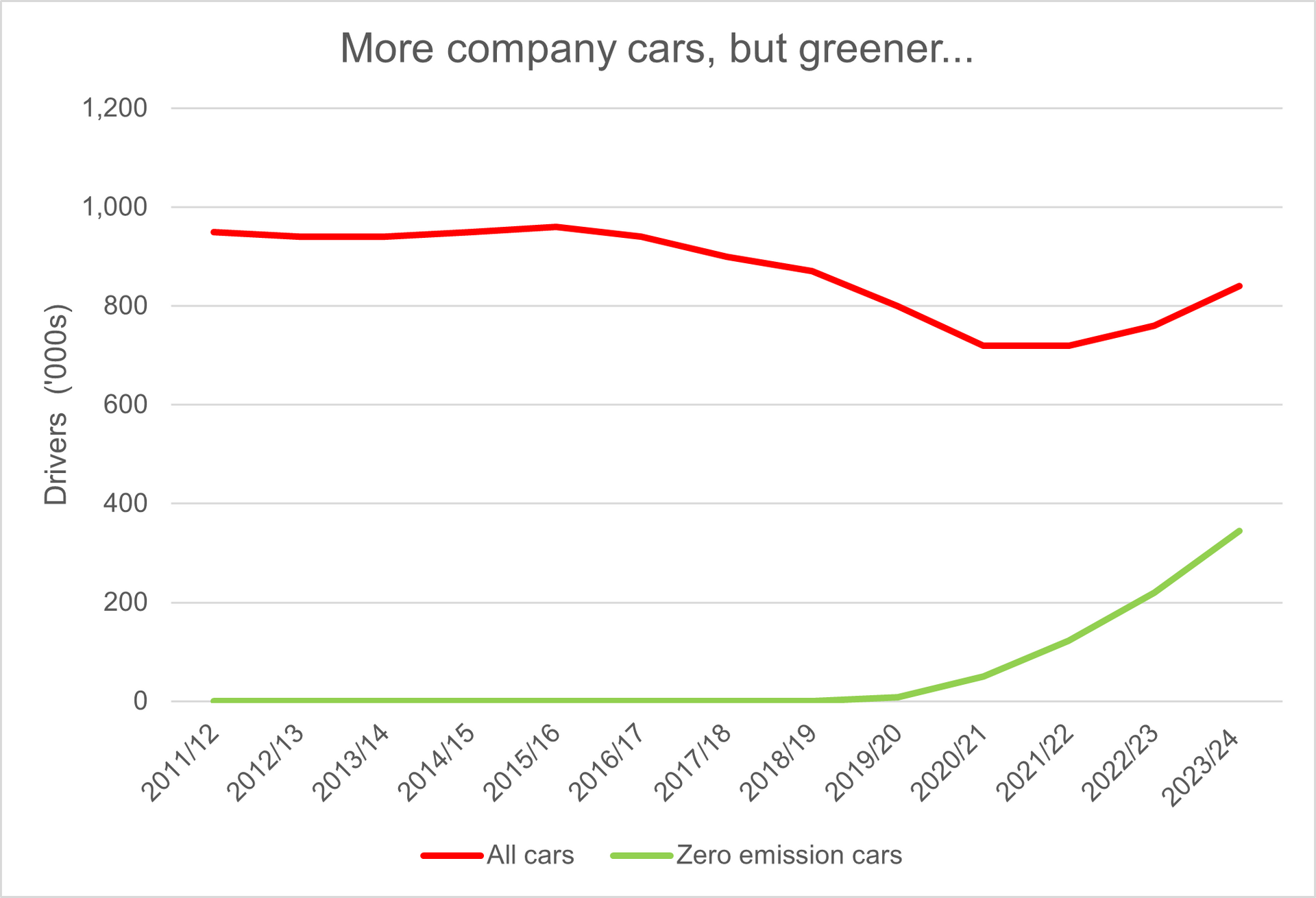

Blog

Cash ISAs twice as popular as stocks and shares ISAs

HMRC figures for 2023/24 show cash ISA subscriptions have increased by around 224% more than stocks and shares ISAs by the end of the decade.

The Chancellor’s plan to reform individual savings accounts (ISAs) to “improve returns for savers” has been considered for some time. Rachel Reeves’s scheme is widely believed to mean the current £ 20,000-a-tax-year subscription limit for ISAs would be reduced for cash ISAs. Unsurprisingly, the investment management industry has been in favour of such a move, while the big banks and the Building Societies Association have been strongly against it.

Statistics published by HMRC in September cast a new light on the ISA debate. The data (see chart below) show that in 2023/24, subscriptions to cash ISAs were £69.5 billion, while stocks and shares ISAs attracted just over £31 billion. That brought the total amount invested in cash ISAs to £360 billion as of April 2024. It would be reasonable to assume the total now is well above £400 billion.

Now put yourself in the Chancellor’s shoes. If the Bank of England had £400 billion earnings and 4% Bank Rate, it would mean £16 billion of interest on which no income tax is being collected. The latest estimate from HMRC is that the cost of income tax and capital gains tax relief for ISAs was £9.4 billion in 2024/25, almost a fifth up on the previous year. Cutting back on the amount flowing into cash ISAs could reduce tax loss, even though the prospect of enhanced returns is a better story to present to the public.

To be fair to the Chancellor, there is some justification in her argument. As HMRC’s ISA Investment values and subscriptions graph illustrates, to a degree, the total value of stocks and shares ISAs grew more rapidly than cash ISAs over the ten years to April 2024. However, cash ISAs saw little net inflow for much of the period. It is easy to forget now that the Bank of England rate was no more than 1% between February 2009 and June 2022, assuring miserable returns for money held on deposit.

Before you rush to arrange a pre-Budget cash ISA, it is worth reflecting on what you are trying to achieve. If you just want to move a ready money deposit to a tax shelter, remember that unless you are an additional/top rate taxpayer, the personal savings allowance (PSA) covers up to £200 of tax on interest (20% for basic rate x £1,000 PSA or 40% higher rate x £500 PSA).

If you are setting aside money for long-term growth, then, as the Chancellor suggests, there could be better options.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances. The value of the investment and the income from it can fall as well as rise and investors may not get back what they originally invested, even taking into account the tax benefits. Investors do not pay any personal tax on income or gains, but ISAs may pay unrecoverable tax on income from stocks and shares received by the ISA managers. Stocks and Shares ISAs invest in corporate bonds, stocks and shares and other assets that fluctuate in value. Tax treatment varies according to individual circumstances and is subject to change. The Financial Conduct Authority does not regulate tax advice.